Zip Finance Apply Now

What They Offer

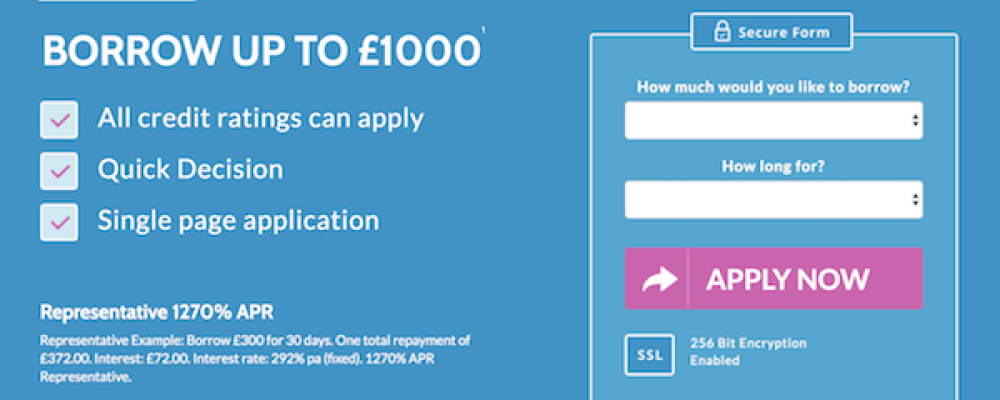

£100 to £1,000 – Rates from 85.9% APR to max 1290% APR – Minimum Loan period 1 month – Maximum Loan period 36 months – Our Rating – –

Borrow from £100 to £1,000 Online Today

Your Overall Rating Of Zip Finance

| Customer Service | |

| Speed of Payout | |

| Repayment Options | |

| Interest Rate | |

|

Average

|

|

Representative Example: Borrow £300 for 30 days. One total repayment of £372.00. Interest: £72.00. Interest rate: 292% pa (fixed). Representative 1270% APR. >>

What they offer

- We’re a broker not a lender.

- Once you fill out our application form we will search our panel to try and find you a loan, this normally takes about 2 minutes.

- If we find you a loan, we will redirect you to the lender for you to get your cash.

- We do not work with every lender in the UK so it is possible that you could find a better loan yourself.

- If we are not able to find you a loan we may refer you to a different solution like debt help or credit score companies which could help improve your financial position.

- We’ll process your application within a couple of minute

- If you’re approved we’ll redirect you to your lender.

- Don’t borrow money if you can’t pay it back

- You should only borrow money if you are certain you can pay it back.

- If you are struggling with your money commitments, then please DON’T borrow more.

- If you have existing loans that you cannot afford to repay, get in contact with your lender and discuss the situation immediately.

- The details of your actual loan will be between you and your chosen lender.

- Please make sure you read and understand the terms and conditions from your lender very carefully before agreeing to the loan.

A short-term option

Short-term loans are always a short-term option. If you don’t fully repay your loan when agreed then your lender could add fees and charges to your loan that make it more expensive. Your lender may also report to the credit reference agencies, so if you fail to meet your repayments, your credit rating might be adversely affected.

Paying back your loan

Most Lenders will use the card details you provide to collect your repayments. You may be asked to set up a direct debit to make your repayments. If they have been unable to collect your repayment on the date its due then they will usually keep trying your card for up to 90 days. Your lenders collection practices should be outlined in their terms and conditions so refer to them if you have any concerns.

Rolling over your loan

If you take out a loan and can’t afford the repayment, you may wish to rollover your loan. Doing this will incur you further charges including additional interest and possibly a fixed charge for missing the original repayment date. Due to these additional charges, the total amount owed can inflate to an unmanageable amount with you quickly losing control of how much you owe.

As part of the new FCA regulations, you can only roll your loan over twice, so it is important that should you find yourself struggling to pay back your loan on the pre-arranged date that you speak to the lender and explain your circumstances.

What happens if you are struggling with your payments?

If you’re struggling to pay back your loan, the worst thing you can do is ignore the problem. Get in contact with your lender as soon as possible to arrange a solution that works for both you and them. It’s worth remembering that you shouldn’t apply for a loan if you think you may not be able to repay it in full and on time.

Read Reviews for Zip Finance

– Scam Advisor – Payday Loans Inc –

Or Post Your Own Personal Rating Here

Customer Service

Speed of Payout

Repayment Options

Interest Rate

Great list of Payday Loan Lenders